If you want to invest in real estate, one of your key considerations should be the state where the property is located and the mortgage regulations followed by that state. With this knowledge, you will know how to recover your money if the borrower defaults on the loan.

Each state has either adopted lien theory or title theory, although some use both. In states that rely on title theory, borrowers and lenders use Deeds of Trust as binding agreements. Conversely, in states that rely on lien theory, mortgages are binding agreements. Both documents serve as contracts between the borrowers and lenders, but they come with varying features that shape the relationship between the parties involved. Here’s detailed information on this topic.

Key Similarities Between Mortgages and Trust Deeds

Both trust deeds and mortgages secure loan repayment by ensuring that the lenders have a legal right to acquire the property in question if the borrower is unable to pay their debt. If a borrower defaults and you, as the lender, have a first position lien, you have the right to foreclose the property and sell it. Essentially, borrowers use trust deed documents and mortgages, to ensure they get back their lent money.

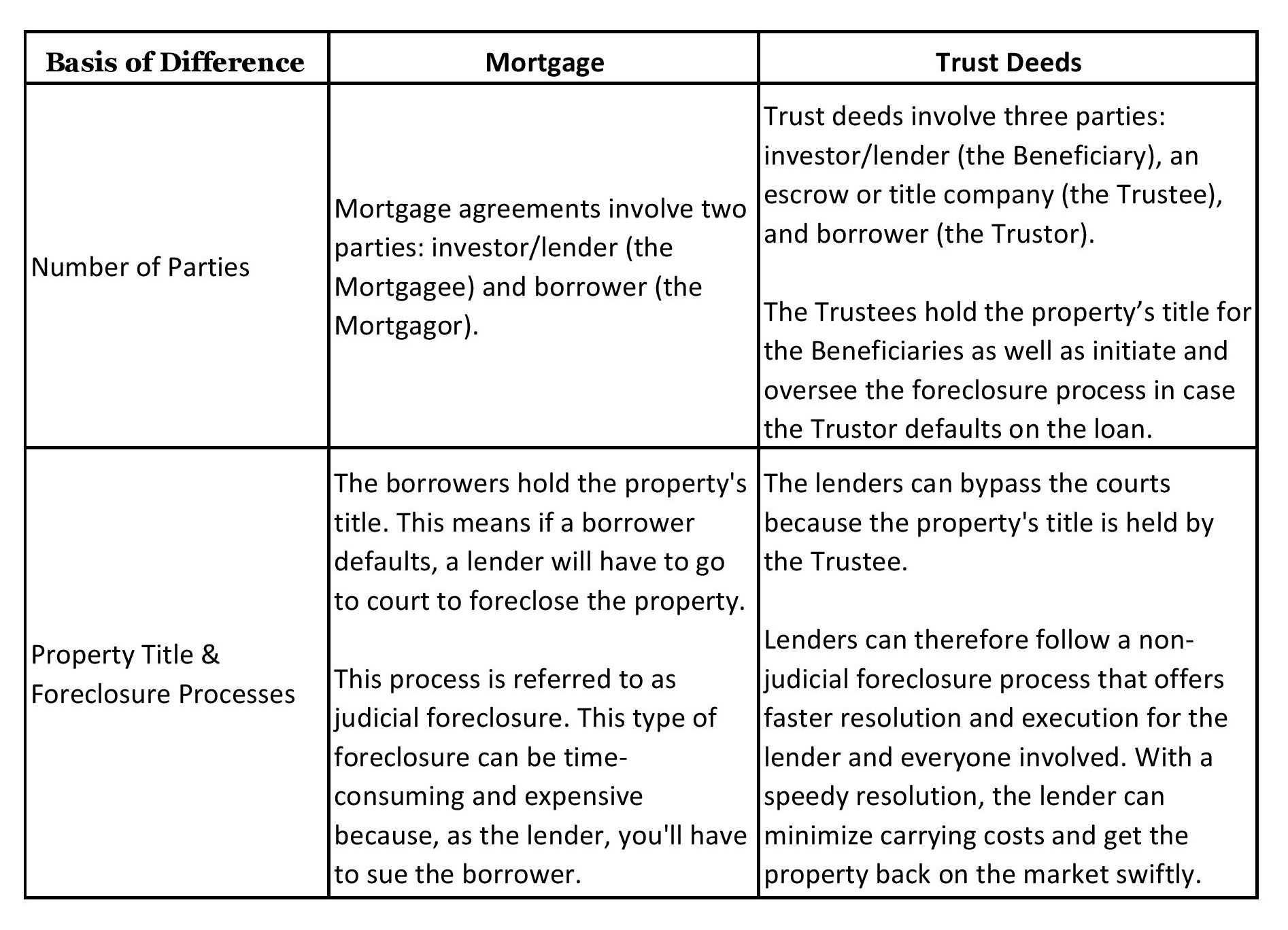

Main Differences Between Mortgages and Trust Deeds

First Trust Deeds

As the name suggests, First Trust Deeds are recorded first and thus precede all other financial liens on the property in question. Other liens could be secondary trust deeds, mortgages, or even subcontractors’ mechanics liens. This means First Trust Deeds are prioritized, and all other liens are subordinate to this loan. Investors should obtain the first position because, in foreclosure scenarios, subordinate liens are usually eliminated. Thus, the lender with a First Trust Deed doesn’t have to worry about the borrowers’ other debts.

Invest in Trust Deeds Today!

Trust Deed Investments are relatively low risk and come with an attractive yield. Thanks to our extensive experience and knowledge at Fidelity Mortgage Lenders, we’ve been making successful Trust Deed Investments for over 50 years and in all market conditions.

Due to our excellent results, we have built a robust long-term relationship with many investors, including financial managers, professional corporations, high net worth individuals, family trusts, and many smaller investors who want to diversify and balance their investment portfolios. Contact us today to learn more!

Comments are closed.