Meet The Team

Meet The Team

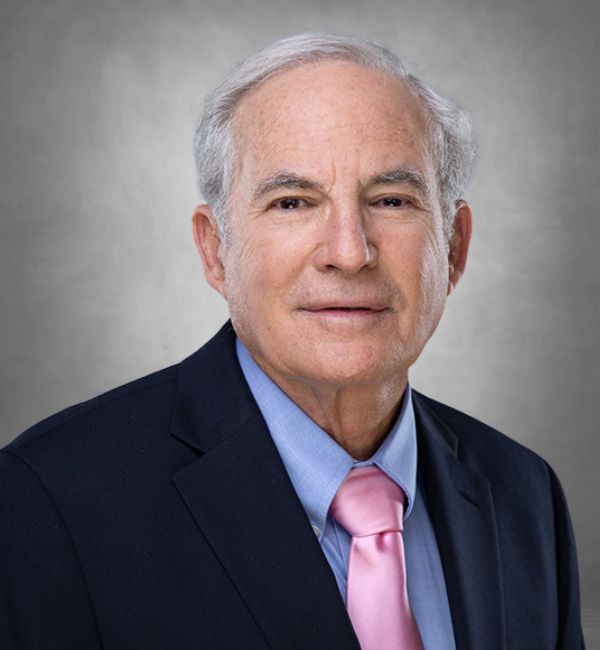

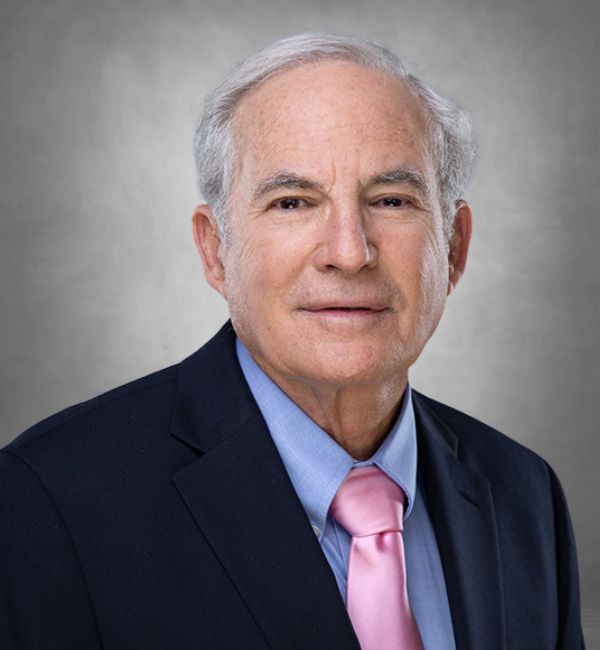

Biography

Since he founded Fidelity Mortgage Lenders, Inc. at his dining room table more than 50 years ago, Charles “Chuck” Hershson has built the company into a private lending powerhouse with more than 22 team members and a product lineup that rivals any in the industry.

Along the way, Chuck established himself as a champion for the community, a supporter of a legion of charitable causes, and a true believer in doing the right thing for clients and employees.

A Founding President of the California Mortgage Association (CMA), Chuck has served on the boards of The Guardians of Los Angeles Jewish Health (formerly The Jewish Home), the Los Angeles Jewish Health Foundation, Cancer Support Community, and American Friends of the Hebrew University. He is a member of the Board of Governors of Cedars-Sinai Medical Center, a staunch supporter of the Jewish Federation’s Real Estate & Construction division, AIPAC, the Harmony Project, and other causes and organizations too numerous to mention.

Around the office, he’s known as “Uncle Chuck” for his highly personal approach to managing. Fidelity offers employees fully paid insurance and pension plans, and Chuck didn’t flinch when Covid-19 shut down businesses. He paid employees for the duration of the lockdown.

“I take care of my people,” he says. “I’ve always been that way.”

Chuck runs the business side of Fidelity with the same sense of responsibility and accountability. His unswerving devotion to clients and insistence on honesty and fairness has earned him a following of investors who, in many cases, have retained their portfolios over three generations.

Fidelity takes a very conservative approach to lending that greatly reduces risk for the investors who back the company’s loans.

“We don’t let our loan-to-value ratios creep up, regardless of the property,” Chuck says. “We put our investors interests first, and protecting their investment is our number one concern.”

A graduate of the University of Southern California with a degree in real estate and finance, Chuck launched Fidelity after working in the private lending industry. Believing he could build a better mousetrap, he burned the midnight oil and took post-graduate courses to refine and implement the vision that he refers to as “a niche within a niche.”

Fidelity began as a residential mortgage lender, but when the housing market collapsed in the 1980s, Chuck pivoted to commercial lending. Today, commercial loans represent 95 percent of the business.

Chuck no longer focuses on day-to-day operations (though he points out that, “Every time there’s a problem, it ends up on my desk”). As Chairman, Chuck devotes his time to the company’s investors, a role he’s always relished and one that’s still custom made for him.

“I love to schmooze” he says, “and I love to laugh and get people laughing. I think my sense of humor is a big part of my success. I genuinely like making a connection with people.”

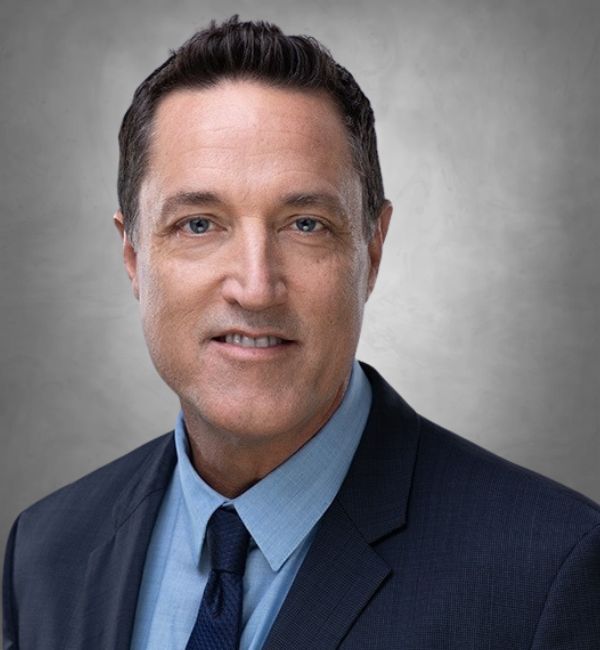

Biography

John MacLean is the Executive Vice President of Fidelity Mortgage Lenders, Inc., and heads up the Company’s Loan Origination, Loan Servicing and Escrow Departments. John is a 25-year banking executive and has funded in excess of $1.5B of commercial, multifamily, bridge and construction loans.

Prior to joining Fidelity, John was SVP of Commercial Real Estate Banking at Banc of California for 5-years and held the position of Executive Director/Senior Loan Consultant, for JPMorgan Chase’s Commercial Term Lending Division for over 10 years. John also held several Senior Management positions in Loan Servicing for over a decade with Washington Mutual Bank and Home Savings of America and was also involved in selling and securitizing thousands of SFR and Commercial loan portfolios.

John received his Bachelor’s Degree in Economics, at San Diego State University and has been a Licensed Real Estate Broker since 1993. He is active in his community and served on the Board of Directors of Habit for Humanity for 12 years and is currently an Assistant Scout Master, for the Boy Scouts of America. John is married with three teenagers and lives in Westlake Village, CA.

Biography

Matt Masterson is the Controller at Fidelity Mortgage Lenders, Inc., where he leads the Accounting Department. He has over 25 years of experience as a banking executive. Born and raised in Southern California, Matt earned a Bachelor of Science in Accounting from Loyola Marymount University and subsequently obtained a CPA license, as well as certifications in Life Insurance and FINRA.

Throughout his career, Matt has held positions at several institutions, including Bank of America, Fremont Investment and Loans, Washington Mutual, Home Savings of America, and Sylvan Learning Center; (where he was the Owner and President). He also served as the Chief Financial Officer of the Peterson Law Firm and was a FINRA Registered Financial Representative.

Before joining Fidelity, Matt worked as Vice President in various banks’ accounting departments, where he was responsible for company financials, cash management, and business analytics. Additionally, he teaches accounting classes at California State University, Long Beach.

Matt is actively involved in his community and has served as an Officer in the Knights of Columbus for ten years. He is married and has four grown children and three grandchildren. Matt currently resides in Seal Beach, California.

Biography

Ralph Haber thinks of himself as a detective. Over the 50 years he’s spent in mortgage lending, he’s handled his fair share of complicated transactions, many requiring the same kind of tireless diligence of an investigator who must turn over every rock to solve a case.

He’s successfully cleared titles that date back through generations of owners, found long lost former spouses, and poured over records that sometimes span several states, all to make sure borrowers avoid surprises and loans close in a timely fashion.

The Cal State Los Angeles graduate joined Fidelity Mortgage Lenders, Inc. 25 years ago. As Loan Manager, he’s been in charge of shepherding all of the company’s loan packages from opening title, to ordering appraisals, running credit, and getting the loan recorded.

Ralph figures he handles 10-20 loans a month, giving equal attention to each transaction, no matter the size. Ask him how he does it, and he’ll tell you simply that he relies on his team and outside partners to get the job done. But his secret sauce is his devotion to clients and a singular focus on making sure clients achieve their goals.

Biography

Neil Sokoler brings over 35 years of banking and lending experience to Fidelity Mortgage Lenders. A graduate of UCLA, Neil specialized in small business lending prior to joining the Fidelity team. Throughout his career he’s closed over a thousand loans totaling more than half a billion dollars.

Neil works with property and business owners, accountants, real estate professionals, investors, and attorneys. He knowledgeably and patiently assists borrowers in the purchase or refinance of their commercial, industrial or investment property. Neil helps clients evaluate loan products and determine the loan amount for which they qualify.

His thorough understanding of financing has even made Neil the go-to resource when colleagues in the lending industry need a hand, as happened when he received a call from a banker who was unable to close a loan for a client. “We had a tight deadline to meet the terms of the purchase agreement and the client stood to lose a significant deposit if the deal didn’t close. I was able to pull together a financing package that worked for her needs and allowed her to close on time.”

Neil delivers results consistently and earns the trust of clients and colleagues alike. “To each client their loan is truly important, and I treat it that way, whether the amount is $50,000 or $15,000,000.”

Biography

Paul Bellgraph has had a 25-year career in commercial real estate brokerage and lending, giving him a unique understanding of the best ways to finance properties. Before joining Fidelity Mortgage Lenders, he spent 20 years in commercial real estate with companies such as Knight Frank, Lee & Associates, and NAI. During this time, Paul leased and sold various commercial properties, including industrial, retail, office spaces, and apartments.

At Fidelity, Paul qualifies borrowers from diverse backgrounds, including property investment owners, business owners, real estate professionals, accountants, and attorneys. He approaches his clients with professionalism, knowledge, and patience, ensuring they feel comfortable while finding the right loan program.

Paul studied business administration at California State University, Fullerton, where he also played rugby. He is a fitness enthusiast, having participated in CrossFit competitions and triathlons and completed three Ironman events. Paul currently lives in West Hollywood, CA, with his two teenage daughters.

Biography

Biography is coming soon.

Biography

Rory Cambra is a 25-year real estate and finance veteran, but he prefers to think of himself as a quarterback for his client’s financing needs.

“At the end of the day, borrowers want to get the best deal they can. It’s my job to listen to their needs and offer the Fidelity loan products that will best address their particular situation,” Rory says. “From there, it’s a matter of taking the deal over the goal line, and that’s my strong suit.”

A consistent top producer, Rory co-founded his own mortgage lending company and built it to 15 loan officers before joining Fidelity Mortgage Lenders, Inc. He grew product sales by 200% over five years, and personally closed more than $100 million in mortgage loans.

As a Loan Officer and Sales Manager responsible for the Orange County and San Diego markets, Rory especially enjoys the challenge of helping borrowers who need specialized services and products that conventional lenders can’t provide.

He prides himself on his ability to build relationships, prefers to answer his own phone, and welcomes all opportunities to meet new people, even when the interaction doesn’t lead to a deal.

As Rory puts it, “Not every interaction leads to a deal, but if a deal can be made, I’ll turn over every stone to make it happen.”

Biography

Steven Hinds is a dedicated real estate finance expert with 37 years of experience, having successfully originated over a thousand loans totaling more than a billion dollars. His enthusiasm for transactions sets him apart, as he genuinely believes that no loan is too small to matter. Steven’s journey began at George Elkins Mortgage in 1986, where he gained invaluable experience as an appraiser before advancing to loan originations. His valuation background has proven instrumental, allowing him to make informed decisions that truly benefit his clients. After two decades at George Elkins, Steven transitioned to Walker Dunlop, where he proudly opened their San Francisco office. He continued to excel in loan origination until 2018 when the company shifted its focus to only large multifamily transactions. This prompted him to relocate to San Rafael, where he originated loans for Elkins Partners, before joining Fidelity Mortgage Lenders, Inc.

Steven lives in Mill Valley with his wife, and his two adult children are both married with children.

Steven’s passion lies in small-balance loans, where he can leverage his expertise in crucial, underserved markets. He understands the importance of these loans in supporting the local economy and enhancing the community, making him the ideal partner for your financing needs.

Biography

For over forty years, Terry Barone has been licensed as a top executive in the real estate and finance industry. His duties have included: supervision of staff, administration, real estate brokerage, property management, property analysis, marketing, training, and underwriting of financing for clients.

Terry is experienced, dedicated to excellence, and well regarded as a trusted advisor for commercial customers looking to refinance or buy commercial property.

To better serve, Terry Barone is currently working with Fidelity Mortgage Lenders to expand their existing loan operations by having a permanent location in Las Vegas. Our private money firm offers flexible terms and fast approvals with minimal paperwork to select customers.

Terry is also a partner involved in a project to build a “Center for Special Needs Children” in Las Vegas. Married to a world-renowned violinist, Terry is working on publishing his second book and enjoys traveling with his wife in their spare time.

Biography

With over 23 years of experience in Real Estate and Financial Services, Tammy Lorenzana has built a strong foundation in Loan Servicing, Process Improvement, and Asset Management. She has worked with various lenders and banks, including Washington Mutual, REDC/FNMA, and JP Morgan Chase, gaining valuable insights into operations, compliance, and financial strategy. Tammy has held key managerial positions, focusing on collaboration, and delivering results. She believes that success comes from creating solutions that benefit clients and borrowers.

“At Fidelity Mortgage Lenders, I am committed to improving processes and supporting the loan servicing team in meeting our shared goals. My collaborative management style fosters innovation and encourages everyone to contribute to our success. I work diligently with our borrowers and investors, ensuring they receive timely and accurate responses, while remaining committed to adhering to regulatory standards and delivering lasting value.”

Outside of work, Tammy is a proud mother of two daughters—one a Boston University graduate now working in Washington, D.C., and the other is in the Sierra Madre Band, Cheerleading, and Girl Scouts. Tammy and her family live in Pasadena.

Biography

Kevin Kwon is a dedicated Loan Servicing Specialist with over five years of experience in the lending industry, specializing in loss mitigation. He has developed expertise in navigating complex borrower solutions and effectively managing risks. Kevin’s background in construction enhances his ability to oversee intricate financial disbursements and ensure compliance with lending guidelines.

During his time at Fidelity, Kevin has demonstrated professionalism and reliability, contributing to high levels of customer satisfaction. He also lends support in various areas beyond loan servicing.

When he’s not helping clients or managing loan processes, Kevin enjoys gaming and exploring new road bike routes on the weekends.

Biography

Matthew Chauvin is a dedicated loan servicing professional with years of experience in the field. After earning his bachelor’s degree from San Diego State University, he took advantage of the opportunities presented by the COVID-19 pandemic to shift from his position as a paralegal to a career in loan servicing. He transformed the uncertainty of the pandemic into a chance for professional growth, developing a strong understanding of loan management, customer relations, and problem-solving skills.

During his time at Fidelity, Matthew has established a reputation for his attention to detail, commitment to customer satisfaction, and ability to navigate complex loan servicing processes. His diverse background, combined with his proactive approach during uncertain times, has made him a valuable asset to Fidelity. He enjoys collaborating with the Fidelity team to provide excellent service to both borrowers and lenders

Biography

As anyone who’s ever bought real estate knows, the escrow process can bog down an otherwise smooth transaction. Not so with Hiromi Uto at the helm.

Hiromi has served as Escrow Officer at Fidelity Mortgage Lenders, Inc. for the past 18 years, and over that time she has turned a complex process with many moving parts into a science.

“I can complete a file in a few hours,” Hiromi says. “I know what needs to be done, and I know where everything is.”

A stickler for details, Hiromi attends to each element of the process with professionalism and consistency. She’s keenly aware of the need for accuracy in a job that hinges on making sure every “t” is crossed and every “I” is dotted, and she’s carefully honed her skills to exceed expectations.

Hiromi joined Fidelity from Fremont Investment & Loan where she served as a customer service representative for just short of 10 years. It was there that she met Fidelity’s CEO, Chuck Hershson, who was so impressed by the way she worked with clients, he recruited her.

She continues to take special pride in her ability to go above and beyond what’s required, such as when loan officers have a special request, or need urgent action.

Biography

Biography is coming soon.

Biography

Greg is a native Californian and a long-time resident of West Los Angeles. He brings 25 years of accounting experience to Fidelity Mortgage Lenders. Before joining us in 2024, he worked in the motion picture industry for 18 years and spent 7 years in the healthcare sector, where he managed the accounting department of an urgent care center in Los Angeles County. An accomplished runner, he has completed seven marathons. In his spare time, he enjoys tending to his Ocean View Farm Community Garden. Greg currently oversees our day-to-day corporate accounting functions, and we are very pleased to have him on our team!

Biography

Shai Zadok is a staff accountant specializing in private lending, with a background in Corporate Finance and Financial Services. He holds a degree in Finance from San Francisco State University, providing him with a strong understanding of financial management, analysis, and reporting. Shai also has experience as a licensed real estate broker, giving him knowledge of real estate markets and lending structures.

In his role as a staff accountant, Shai is responsible for managing accounting functions such as financial reporting, budgeting, and preparing financial statements. He ensures accuracy, transparency, and compliance with regulatory standards, contributing to the management and growth of private lending portfolios.

Shai is a native Angelino, born in Hollywood, CA. He is family-oriented and enjoys spending time with his nieces, nephews, and cousins. He also volunteers at the Karsh Center at Wilshire Boulevard Temple’s Food & Nutrition Security program and the Jewish Home for the Aging. In his free time, Shai enjoys cooking, flying kites, playing poker, attending concerts, and exploring art.

Biography

Meet Tracey, a friendly California native who grew up in the greater Los Angeles area. Her adventures began when she had the incredible opportunity to study abroad in Europe as a foreign exchange student at Howard University in Washington, D.C., where she pursued her passion for Political Science.

In the late 1990s, Tracey took her academic skills and dove into a career as a Legal Investigator at the well-known law firm Masry & Vititoe, focusing on Environmental Toxic Tort cases.

After a rewarding time in the legal field, she decided to explore new horizons. In 2013, she stepped into the world of commercial property management as an assistant to a property manager. By 2015, she had obtained her Real Estate License, and in early 2017, she made an exciting transition into commercial brokerage, development, and investment.

Now, Tracey has chosen to take a step back from her fast-paced career to join us as an Administrative Assistant in the financial investment industry. With her exceptional customer service skills and a wealth of knowledge from her diverse experiences, Tracey is here to support our team and clients with a smile! We’re thrilled to have her on board!