Commercial real estate (CRE) encompasses properties built for business operations. These include office buildings, retail malls, hotels, and complexes. Different types of commercial real estate loans provide the funds to purchase or build these properties from the ground up. Read on to learn more about business mortgage options.

Understanding Commercial Real Estate Loans

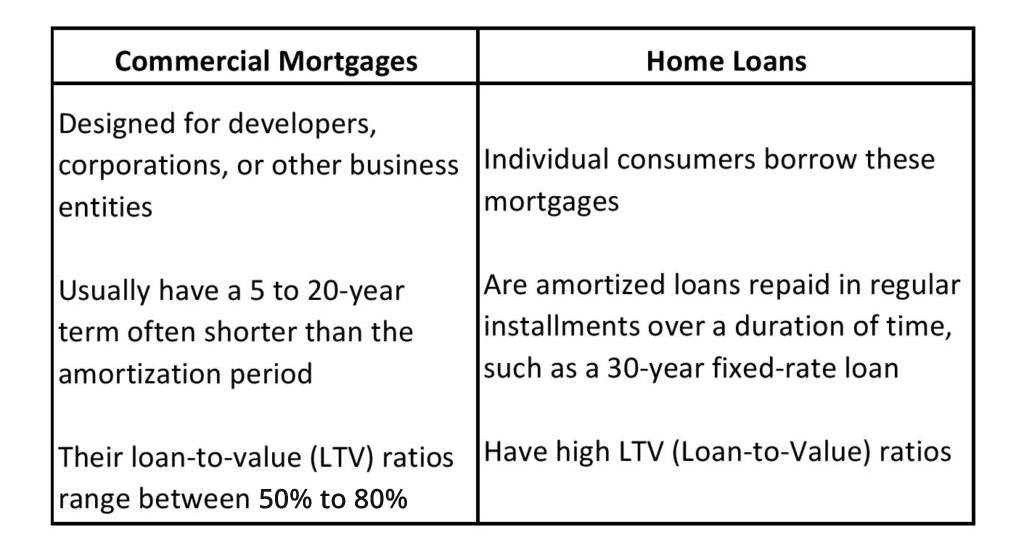

A commercial real estate loan provides an individual or business with the money to acquire or build a business or income-generating building. Commercial loans differ from residential mortgages in key ways.

Read Also: APPLYING FOR A COMMERCIAL LOAN? HERE’S WHAT YOU NEED TO KNOW

Types of Commercial Real Estate Loans

Commercial property loan options include:

- SBA loans: These loans are backed by the U.S. Small Business Administration. You can submit your application for an SBA-backed commercial mortgage to a traditional lender.

- Permanent loans: These are the most common commercial property loans and usually have a longer amortization period than other options. Their terms are similar to home loans, and they’re often personalized to suit the investor’s unique requirements.

- Hard money loans: Private companies or individuals issue these high-interest loans secured with the value of the property. Your ability to repay the loan isn’t critical with these types of commercial mortgages.

- Bridge loans: Financial institutions issue these short-term, high-interest loans. They provide quick funds for purposes like cash-flow sustenance during property upgrades.

- Blanket loan: With this option, you may acquire multiple properties with a single commercial mortgage. However, it may be difficult to sell off any of the financed properties before fully repaying your mortgage.

Interest Rates and Fees

Commercial property loans attract higher interest rates than home mortgages. Overall, they’re more expensive because of additional fees for things like appraisal and loan application.

Loan Repayment

Typical commercial mortgages have a term of 5 to 20 years, which is usually shorter than the amortization period. For instance, a 7-year commercial loan may have a 30-year amortization period.

How to Find the Right Commercial Property Loan

Here are some factors to consider when looking for the right mortgage to build or purchase a commercial property:

- Your LTV ratio (You may qualify for better loan terms if you have a low LTV as it means you have more equity in the property)

Interest rates and fees - If the property has a lower debt-service coverage ratio (DSCR), it can more easily qualify you for a commercial mortgage with a shorter amortization period

- Any prepayment restrictions, such as penalties or lockouts (lenders have these rules to protect their anticipated profits from a loan)

- The repayment schedule (you’d pay more for a commercial loan with a longer term and amortization period than a traditional loan)

Commercial Real Estate Loans at Fidelity Mortgage Lenders

Are you looking for a commercial property loan that suits your investment goals? At Fidelity Mortgage Lenders, we pre-qualify loans based on the property value. We’re offer our customers more real estate financing options at favorable terms. Contact us today to learn more!

Comments are closed.